ZoomInfo Intent Data: Is It Any Good?

You’re likely considering ZoomInfo intent data because you want to:

- Connect with buyers who are most likely to purchase your product.

- Be the first to connect with customers who are in-market to buy a product or service like yours.

- Shorten your sales cycle and increase conversions.

But are ZoomInfo’s intent signals good for helping you find your best buyers?

In this article, we’ll examine how intent data works with ZoomInfo and whether there might be a better alternative.

Let’s go 👇

Looking for a ZoomInfo intent alternative?

Get in touch to test Cognism’s data.

How does ZoomInfo’s buyer intent data work?

ZoomInfo gathers buyer intent data from several sources, including:

- Proprietary machine-learning technology.

- Bidstream.

- Partnerships with other websites.

ZoomInfo employs advanced algorithms to aggregate data from bidstream auctions and data co-ops. Following this, the patented Intelligent Keyword Extractor (IKE) and other natural language processing technologies analyse websites for B2B topics. Intent signals are then associated with topics based on consumption.

Sounds good, doesn’t it?

While there are upsides to how ZoomInfo intent data works, there are downsides, too.

The most glaring is the use of bidstream data, which is the collection and auction of website ad impressions.

This means that when a prospect clicks an ad on a participating website, ZoomInfo receives this as an intent signal, which they provide to customers.

There’s no guarantee of the data’s accuracy. Since users aren’t notified that their data is being used for marketing and sales purposes, it’s said to go against compliance regulations like GDPR.

If you’re looking for quality B2B data and are serious about compliance, this article might interest you - bidstream intent data. It’ll explain why it’s not the best investment and what kind of intent data is.

Cognism is compliant by default

While both ZoomInfo and Cognism are CCPA and GDPR-compliant B2B data providers, the key differentiator is that Cognism scrubs all mobile numbers against broader Do-Not-Call (DNC) lists.

If you’re serious about compliance, then consider Cognism.

Our intent data, powered by Bombora, is fully GDPR-compliant. We also scrub all our mobile numbers against:

- TPS/CTPS lists in the UK.

- Do-Not-Call lists in a record 13 countries: the UK, USA, Canada, Australia, New Zealand, Belgium, Croatia, France, Germany, Ireland, Portugal, Spain and Sweden.

- If a number is marked as TPS or DNC, the user has opted out of receiving unsolicited phone calls by applying to the national do-not-call registry.

Cognism allows admins to choose whether to hide or show contacts on DNC lists from reps, meaning that its customers have complete confidence in the legality of their outreach.

The Cognism platform follows these compliance-based actions:

- A stringent B2B data verification process.

- Ensures all data is legally sourced and of the utmost quality.

- Is regulated by the ICO and provides users with a notified database.

SDR Manager @Cloudreach

How accurate is ZoomInfo’s intent data?

Looking at G2 and Reddit discussions, ZoomInfo appears to have improved its intent data service over the last two years.

Many Redditors mentioned feeling as if they were using the product wrong, as buyers with 100% intent weren’t actually interested. Others were annoyed by ZoomInfo’s lack of accuracy.

ZoomInfo has since partnered with G2 for buyer intent. It launched Streaming Intent, which is essentially real-time intent data and works to provide intent change alerts for its AI offering, Co-Pilot.

By integrating insights from multiple platforms, including their proprietary datasets and external partnerships, ZoomInfo aims to build a comprehensive picture of buyer intent. However, as discussed earlier, reliance on bidstream data can introduce inconsistencies and inaccuracies.

Check out Cognism’s intent data powered by Bombora:

- Bombora intent data tracks over 14,000 intent topics across B2B websites, such as Forbes, Bloomberg, Time, and CNN.

- Bombora monitors articles, subscriptions, webinars, infographics, registrations, case studies, white papers, and specific search topics.

- It looks for patterns in these sources and highlights companies actively seeking information.

- The analysis generates a score by considering the number of interactions, users, topic relevance, and engagement, resulting in a better-quality dataset with accurate data.

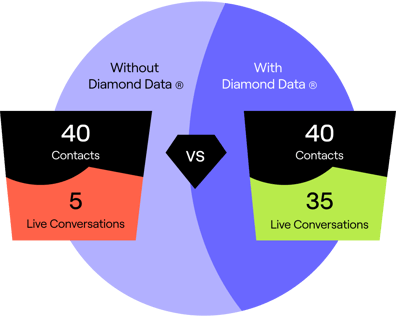

Nothing can break a connection built on diamonds

By combining Cognism’s intent data with Diamond Data®, you’re more likely to connect with the right customer 87% of the time.

Cognism’s premium phone-verified cell phone numbers help you:

- Access over 10M+ phone-verified contacts globally.

- Connect with up to 87% of your list.

- Increase your connect rate by 3x.

- Source and verify information on demand.

How does ZoomInfo intent data compare to Cognism?

Sources

The major difference between ZoomInfo and Cognism buyer intent data is that both tools use different sources.

ZoomInfo collects intent data from different sources and employs its own machine-learning technology to identify buying signals. One source is said to be bidstream intent data.

ZoomInfo’s intent data takes a broad view of buyer intent, as not all ad clicks represent companies interested in purchasing. Accidental clicks on ads happen frequently, and even if a buyer clicks on an ad, they may not be ready to buy.

Cognism partners with Forrester Wave leader Bombora, who is equally committed to compliance and accuracy. Bombora’s intent data shows companies actively searching and ready to buy. It also tracks companies that are passively looking but aren’t identifiable until their activity increases.

Compliance

Regarding compliance, Bombora gathers consent, offers opt-out choices, and manages privacy from the OneTrust platform. However, due to how bidstream buyer intent is obtained and sold, ZoomInfo may not follow the same stringent privacy laws.

Quantity & topics

Cognism’s partnership with Bombora means users can access 12,000+ intent topics compared to ZoomInfo’s 5,000.

While ZoomInfo continuously adds topics to its intent signals, you should remember that bidstream data often includes vast volumes of data. However, there’s no context to the data, so only a limited number of signals might result in a lead.

So, while a co-op intent database might be smaller, the data focuses on reducing noise and providing leads showing interest in purchasing.

Exclusivity

Bidstream buyer intent is available to buyers who bid on advertising space, ad exchanges, or impressions.

Bombora’s co-op members collect 100% of intent - even from ad-free sites, and over 70% of these sites are exclusive to Bombora.

You can access Cognism’s intent data directly via the Sales Companion Web App and Browser Extension.

Take an interactive tour to see how it works 👇

Expanding into new markets?

Finding accurate data just got 75% faster!

Drop manual processes and drive quality data adoption with Cognism’s AI Search.

Cognism AI Search connects you with your ideal prospect 75% faster.

Build targeted lists or find decision-makers with three different search routes:

- Text-to-command search: Think of your ideal target list and then type it into the search bar.

- Direct prospect or account search: Got a specific person in mind? Search for them by typing in the AI Search bar.

- Voice search: Expanding into new markets? Our voice search has multilingual support to help you prospect in your native tongue.

Is ZoomInfo intent data any good?

There are many pros and cons to using ZoomInfo’s intent data, which we’ve covered above.

ZoomInfo users have mentioned that the intent platform could be improved, as exports sometimes lose selected companies and instead display every employee for each company shown for the intent signal.

Others have not had success reaching potential prospects flagged from ZoomInfo’s intent signals, and a few users complain of inaccuracies.

At the end of the day, it all depends on what you need for your business.

If you’re serious about compliance and looking for accurate contact data without expensive add-ons and credit consumption, then Cognism is for you.

Intent data is included in our Elevate package, along with all integrations and unrestricted access to high-quality global contact data.

Locked into a contract with ZoomInfo and need a way out?

Don’t sit and wait for your ZoomInfo contract to run out! Making the switch to Cognism is easier than you think.

Here’s what you get with Cognism:

- Sales Companion (Web App): Access a vast database of contacts, companies, and buying signals.

- Sales Companion (Browser Extension): Access company and contact details on LinkedIn and other platforms.

- Diamond Data®: Phone-verified mobile numbers for B2B contacts.

- Intent data by Bombora: Identify companies researching topics relevant to your business.

- Cognism AI Search: Find prospects with ChatGPT-style text or voice prompts.

- Cognism Enrich: Instant and scheduled CRM enrichment and on-demand CSV enrichment.

- Seamless integrations with CRMs and sales and marketing tools.

- International coverage: EMEA, NAM, APAC.

- Fully GDPR and CCPA-compliant data.

- Database checked and cleaned against global DNC lists.

- Fast and friendly support team.

- Unrestricted access to person and company-level data (subject to fair use policy).

Head of Revenue Operations @Bright Network

Is there a better intent data provider than ZoomInfo?

Choosing an intent data provider often means choosing a tool with extra features that are helpful for your business, as intent is generally an add-on.

The most in-demand features are a fantastic contact database and a data verification process to ensure your teams aren’t wasting precious time.

ZoomInfo is a fair tool for marketing, sales and recruiting teams looking to prospect in the US.

However, if you’re looking for a tool that makes it easier to prospect globally without limited credits and expensive add-ons, choose Cognism.

.webp?width=1000&height=267&name=Slalom-logo%20(1).webp)

Put our data to the test

Get 25 free leads and learn how Cognism can help you achieve the same results with 80% fewer calls.